📏 Coverage to Capital x Henri Servaes: Quantifying PR's Impact on M&A Success

A new academic study reveals how public relations advisors drive deal value - with returns that surprise even the researchers.

When Professor Henri Servaes began studying intermediaries in M&A transactions, PR wasn't on his radar. As a finance professor at London Business School, he'd spent decades examining how different players impact deal outcomes. But one finding stopped him in his tracks.

"To my surprise, a lot of companies in M&A hire public relations advisors," he says. "In our sample, a public relations advisor was hired in 16% of the transactions though this figure can be higher.”

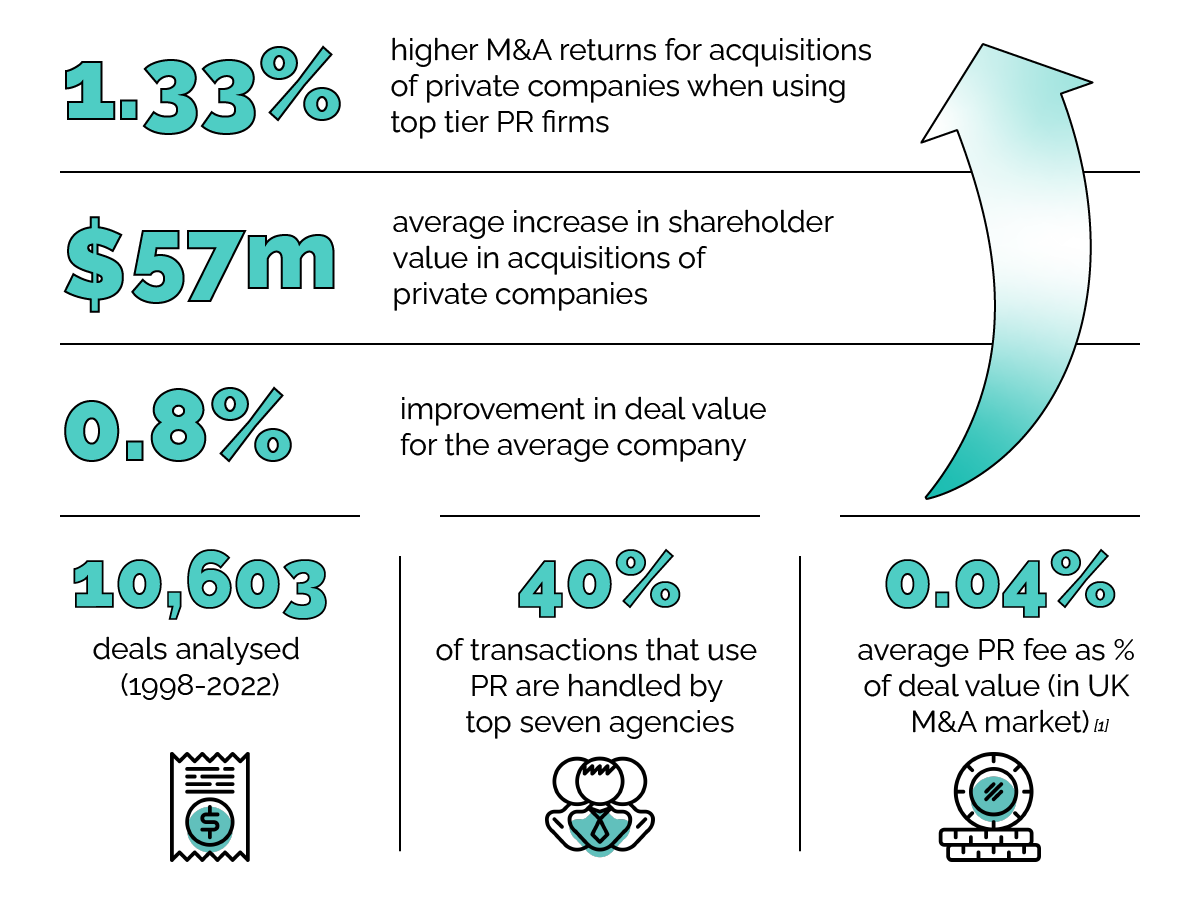

Companies employing PR advisors generate returns 0.78% higher than those that don’t. For private company acquisitions, that number jumps to 1.33%.

This datapoint has led to a new study analysing 10,603 M&A transactions. Co-authored with Durham University colleagues Zhiwei Hao, Dimitris Petmezas, and Huizhong Zhang, Henri’s latest research looks at the impact of top-tier public relations firms on deals by US companies between 1998 and 2022.

The findings? Companies employing PR advisors generate returns 0.78% higher than those that don’t. And, for private company acquisitions, that number jumps to 1.33%. While these might sound like modest gains, they're extraordinary in context.

"The average buyer makes virtually nothing in M&A," Servaes explains. "The returns are essentially zero. And if they buy listed companies, their returns on average may well be negative. People would do a lot for just a few basis points. So 0.1% or 0.15% could already make a huge difference."

The magnitude of the impact initially gave Servaes pause. "My initial take when we saw the numbers was the number was too big - too much value to ascribe to PR firms."

But anecdotal conversations with investment bankers appear to validate the findings. "They're all extremely positive," he notes. "They're all essentially saying it is absolutely crucial that you get your communication right - what and when you're going to release what type of information. PR’s role is to communicate but we see [that] role very broadly."

"It takes years to build up reputation, but you can destroy it very quickly."

PR is crucial in protecting and enhancing what Servaes terms 'reputational capital'. "Reputational capital is very valuable because it brings to bear all the experiences that you've had," he explains. "It takes years to build up reputation, but you can destroy it very quickly." During an M&A transaction, that carefully built trust and credibility faces its greatest test. And it's one that plays out across every relationship.

"During a merger, everybody gets nervous," observes Servaes. "Employees may be nervous when there’s a merger on the table because, are they going to keep their job or not? And suppliers and customers also want to know what the new company is going to look like... If the target and the bidder had different suppliers, will I still be out there?"

The study revealed that PR advisors create particularly significant value in specific scenarios. "With private targets, there is just less information out there. And so communication might be more important," Servaes hypothesises. "Similarly, when there's less analyst following, there's less information. So more communication is good." The effect is also stronger for smaller buyers than bigger ones - though this doesn't mean PR isn't valuable in other circumstances.

The research team approached the question with four possible explanations for PR's role in M&A:

1. Camouflage: Using PR to obscure problems with poor deals

2. Spin: Creating temporary positive sentiment that would fade over time

3. Signalling: Communicating that a deal is already good

4. Effective communication: Communication itself enabling deal success and value creation

The data ruled out the first two hypotheses entirely. "We have 10,000 transactions and if you look at the statistics, you just don't find any evidence to support camouflage at all," concludes Servaes. The signalling hypothesis - where PR simply announces inherent value - found some support, but the strongest evidence pointed to the fourth explanation.

"Without communication, you won't be able to achieve the financials"

Effective communication isn't just about announcing value - it's fundamental to creating it in the first place. "Without communication, you won't be able to achieve the financials,” according to Servaes. “If your workers don't buy into it, or your customers don't buy into it, you simply won't be able to."

Even more significantly, the value gains don't reverse over time, suggesting PR's impact creates sustainable rather than temporary value. "What the market essentially says is that upon the announcement, you're handling this well, you're communicating well," he adds.

The findings raise important questions about how PR firms price their services. "Going back to the research I did almost 30 years ago on investment banks, we found that they're worth their fees, but once you pay the fees, there's no return effect anymore - it nets out," Servaes recalls. "With PR [firms], it seems that they're worth more than the fees they're charging because the return effect still shows up."

In a field where success is often quantified in terms of awareness and reach, leave it to a finance professor to speak the language of returns and shareholder value. "Nobody hired me to do this research or come up with certain conclusions," he adds. "If we had found a negative effect, I would have been telling you that as well. It's just not there."

You can read The Role of Public Relations Advisors in Mergers and Acquisitions paper in full HERE.

[1] The Perfect Information M&A Insight Market Analysis Report for 2021 by Mergermarket (Maftah, 2022)

🤖 Missed our latest Coverage to Capital research? Find out how AI is impacting corporate reputation and how robots read the news HERE.